IDENTITY VERIFICATION AUTOMATION

Verify users identity & supercharge your → onboarding

Industrialise the sending and control of the documents required to open payment accounts using OCR (Optical Character Recognition) technology and streamline the customer journey. If necessary, our KYC experts perform additional visual checks on the required documents to identify the different types of entities in your ecosystem (natural and legal persons).

+1K

Join other marketplaces and streamline payment flows

Verify users in a few seconds

Verify users quickly and in compliance with regulations.

With Lemonway’s fully automated verifications, you can verify your users instantly, understand why users have been rejected, and fight fraudsters.

Create a quick and easy connection to your customers

through fully automated KYC procedures, from identifying your customers through to opening their payment account, verifying and validating the documents required for KYC procedures

Offer a simplified customer KYC experience

and fast onboarding for your platform

Improve your conversion rates

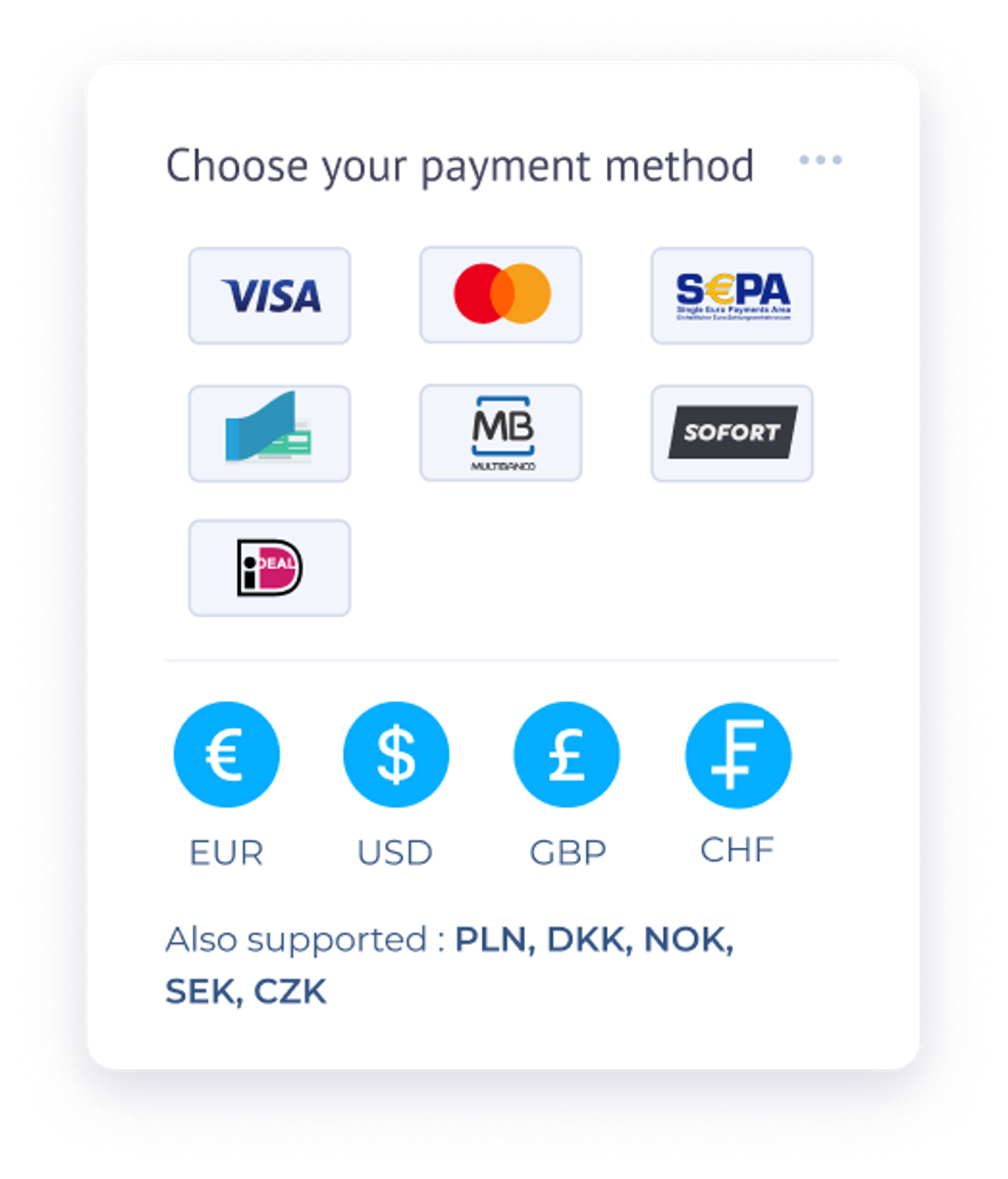

with an optimised payment experience

All the verifications you need. All in one place

Global coverage, automated verification & powerful document verifacation to fight fraud.

Diverse regulatory standards can complicate expansion into new markets and require a patchwork of vendors to meet local requirements. Our verifications range from global to hyperlocal so you can work with one trusted partner.

Quickly identify and stop fraud attacks with an AI built for accuracy and continuously improved by our in-house KYC API. Our unique micro-model architecture uses machine-learning models trained to detect specific fraud markers. Our micro-models analyze pixel-level variations in document color, shape, and texture to assess authenticity accurately.

Create confidence in a customer’s identity by verifying a photo ID. Powered by Onfido Atlas™ AI, our document verification delivers actionable results that are fair, fast, and accurate. We support over 2,500 document types in 195 countries.

Global document coverage

Stop fraud before it impacts your business

Our document verification is powered by Atlas AI. Built on data from tens of millions of global document verifications, Atlas is composed of 10,000+ micro-models that detect specific fraud attack vectors with precision.

Frictionless fraud prevention

Identify fraudsters before they access services using passive signals that present zero friction for genuine customers while keeping fraudsters out. Staying ahead of today’s digital fraudsters involves a mix of fraud prevention technology, deduplication techniques, and education

Enable compliance and risk management

Ensure your business remains compliant with AML and KYC regulations with adverse media, PEPs, and sanctions watchlist solutions. Avoid penalties and fines by ensuring risk controls and audit trails with accurate reporting.

Compliant and certified

We are committed to protecting consumers’ card data in compliance with the Payment Card Industry PCI DSS. Our alignment with this standard is reflected in the people, technologies and processes we employ. We conduct regular vulnerability scans and penetration tests per our business model’s PCI DSS requirements.

Contact us to know more about our features

Ready to boost your marketplace

Trust the pan-European payment service provider Lemonway, which already supports hundreds of B2C marketplaces in managing their payment flows. Contact one of our payment experts!